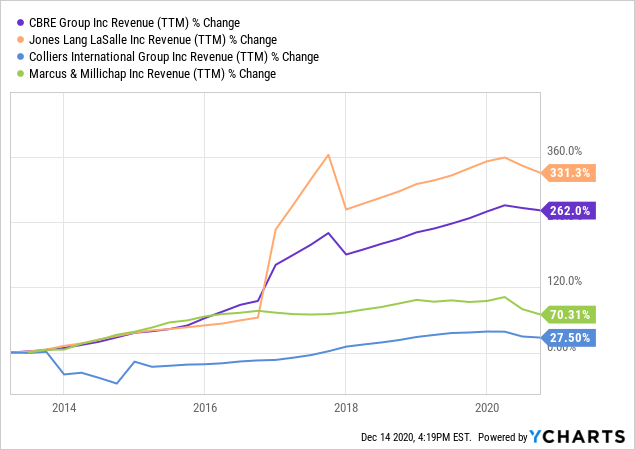

Data by YCharts

Summary

- CBRE Group is trading at a record price and valuation despite considerable weakness in the CRE market.

- The CMBS delinquency rate remains at high levels while commercial rental growth is turning negative due to oversupply.

- Large corporations continue to shift toward the work-from-home which will likely exacerbate excess inventories in the office and multifamily property markets.

- CBRE has depended on reducing operating margins in order to pursue growth which implies competitive pressures are growing and its market-share may have peaked.

- While CBRE is an industry leader, the industry is in a weak long-term economic position and its stock appears overvalued, creating a strong short setup.

- Looking for a portfolio of ideas like this one? Members of Conviction Dossier get exclusive access to our model portfolio. Get started today »

(Pexels)

The U.S commercial Real Estate industry has had a very difficult year. At the onset of the crisis, the volume of commercial real estate transactions plummeted by 71%. There has been a significant increase in volumes, but they were still down 57% YoY during Q3. Prices have risen slightly due to the decline in mortgage rates, however, it is not clear that the rally will remain in the commercial property space as Office and Multifamily properties' excess inventories surpass levels seen in 2008. Excess inventories are also reaching 2008-2009 levels for most other major commercial property segments.

There is little reason to believe the surplus will fade next year. The surge in new home demand is fueling a major single-family construction boom next year. Millions of renters have taken the events of 2020 as an opportunity to leave cities and buy homes in the suburbs. Many major employers are now planning to permanently shift to work-from-home as the possible declines in productivity often outweigh the costs of leasing office space.

The CEO of CBRE Group (CBRE) Bob Sulentic recently said he believed that 80%+ of the lost occupancy will return. While this may be the case, booming suburban home sales indicate many employees believe the shift will be permanent. Of course, if working from home becomes normalized among top corporations then it could easily become the norm for most white-collar work due to network effects.

Despite the substantial evidence of weakness in the CRE market, CBRE stock has rallied to an all-time high this year. To be fair, the company managed to weather a difficult year quite well. The stock also has strong value, growth, and profitability metrics making it among the highest-rated Real Estate servicing companies. However, while today's numbers are good, I believe they will weaken considerably over the next year. Indeed, CBRE is looking bearish and there may actually be a strong short-selling setup for the stock.