Summary

- FEAC announced a special meeting on December 16 that is a catalyst for the stock to appreciate further.

- I believe there is 50%+ upside and sound fundamentals in Skillz.

- The long-term management outlook bodes well and I recommend initiating a position before the meeting.

Thesis

Flying Eagle Acquisition Corp. (NYSE:FEAC) announced a merger with Skillz earlier this year. Looking closer at the deal, FEAC is poised to pop post merger and as Skillz grows into a more mature casino sports company. Given the management history, track record with SPACs, and core operating metrics, I am recommending a buy and hold with this name. I see 50%+ upside based on my analysis of past companies in the space.

Upside

Skillz is a well run gaming company that is mission driven and riding major tailwinds. It has well over $1.6 billion in gross marketplace volume and over 2 billion tournaments played per year. As a new generation emerges that is smartphone-first, I believe gaming and gambling are going to grow in big ways.

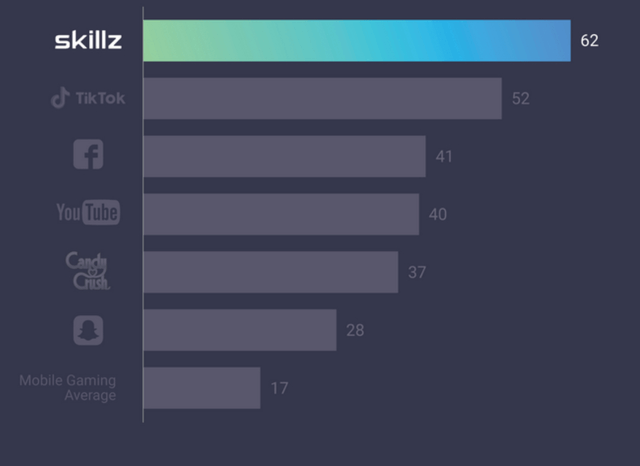

Skillz is also successful at getting users back to the platform - the most common problem with gaming companies in general. It ranks above TikTok, Facebook (NASDAQ:FB), and other platforms in minutes played per day. I believe this bodes well for the general effectiveness of the platform.

Source: Investor Presentation

Further, I truly believe that a new generation of creators and developers will emerge. This group of developers will bring new types of games to life that will build a content flywheel to attract all types of gamers. This will create a longer lifetime value than other gaming platforms that have in-house developers that mostly cater to people like themselves. This flywheel is real and just getting started. We see similar phenomenon with Unity (U) and other platforms moving in this agnostic developer direction. The world has many types of gamers, and those platforms that make it easiest to develop will win.

Source: Investor Presentation

Economics and Market

This strategy is already showing up in the unit economics of the business. I believe the short payback period, impressive nearly 4x LTV/CAC and stunning growth rate will make Skillz a best in class gaming and gambling play that trades in line or higher than DraftKings (DKNG). Here are some basic statistics that demonstrate the scalability of the product.

Source: Investor Relations

This is also a bet on the gaming and gambling market. I believe the mobile part of that market is growing fastest and will continue to grow as a new generation of spenders are mobile-first and comfortable with payments on their phone. Apple (NASDAQ:AAPL) and many others are standardizing and normalizing transacting large dollar amounts on the go, and this tailwind will benefit Skillz. Just the underlying market growth brings my market growth assumptions and company assumptions to 20%.