Summary

- DaVita's business model is able to provide the company with very reliable and stable revenues, as patients need their dialysis treatment on a constant basis.

- In spite of the aggressive stock buybacks, the company's valuation has failed to take off, as DaVita's valuation multiple has remained rather cheap, predominantly below 20X earnings.

- DaVita has the potential to deliver double-digit in the medium term, powered by aggressive capital returns and an attractive valuation.

- Looking for a helping hand in the market? Members of Wheel of Fortune get exclusive ideas and guidance to navigate any climate. Get started today »

The market opened bright green this week, with the Nasdaq rallying more than 2.5% higher as I am writing this article. Growth stocks, particularly in tech, have been treating us well for quite some time now. However, as we are looking to allocate capital anew, identifying some attractive value stocks seems ideal at the moment. With valuations expanding higher in the market, investing in some rock-solid value stocks seems like a prudent option in order to improve our margin of safety.

One such company we have been assessing for a while is kidney dialysis services provider DaVita (DVA), which we believe displays a recession-proof business model, with a great focus on shareholder returns.

An all-weather stock

DaVita's business model is able to provide the company with very reliable and stable revenues, as patients need their dialysis treatment on a constant basis. As a result, adverse times such as those of the Great Financial Crisis or the recent pandemic do not negatively affect the company's performance.

For example, during Q2, total U.S. dialysis treatments were 7,570,908, or an average of 97,063 treatments per day, representing a per-day increase of 0.7%. Despite the variance that other companies have seen in their results due to COVID-19, DaVita's operations remain incredibly stable because of how essential the company's continuous treatments are.

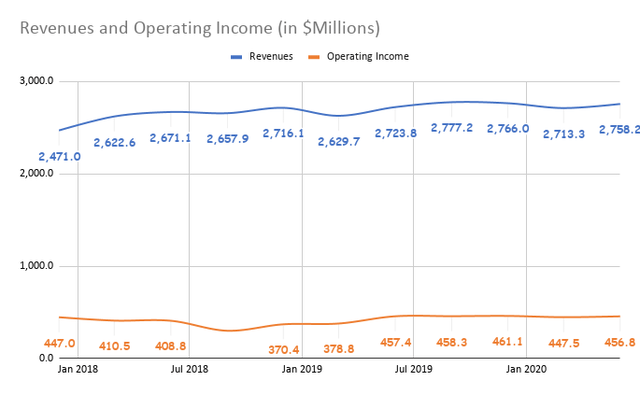

Source: Data from Seeking Alpha, Author

For over 20 years, chronic kidney disease levels have remained steady at around 14% of the US population. The company's performance is likely to remain robust in the long term as well, as the loss of kidney function is normally irreversible. At the same time, the company has been gradually growing as it increases the availability of its services over time.

Despite the DaVita's relatively thin net income margins, which average around 5%-12%, profitability has been consistent. Consequently, DaVita has been generating robust free cash flows. Despite gradually growing its CAPEX, cash from operations has been expanding consistently, leading to increasing free cash flows.