Summary

- As excitement around Disney's DTC business grows, so is the company's valuation which is still near all-time highs.

- Transitioning the business to DTC-oriented model would most likely fail to provide high Return on Equity into the foreseeable future.

- Similarly to Disney's profitability, its massive revenue generating intellectual property (IP) library also seems to have reached a peak.

History Doesn't Repeat Itself, but It Often Rhymes.

- Mark Twain

Source: ksmmedia.com

Growth hype and its implications on price

Disney (DIS) is flying high on the back of retail hype, excitement around its DTC subscribers growth, massive addition of IP through the 21st Century deal and last but not least, the company's unique business model that monetizes IP through theatres, theme parks and merchandizing.

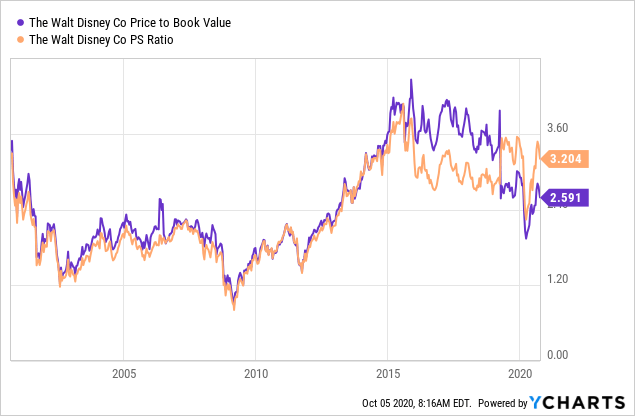

With a forward P/E ratio of x46.7, both P/S and P/B ratio still gravitating near values last seen during the dot-com bubble and a free cash flow yield on last twelve months basis of only 1.7%, Disney is by no means a cheap stock.

Data by YCharts

Data by YChartsComparing DIS valuation multiples to those of Netflix (NASDAQ:NFLX), for example, does not make sense as the two companies' capital intensity, growth profiles and returns on capital are very different. On top of that, justifying DIS valuation by looking at the most speculatively valued parts of the market is also not the right way of looking at this.