Summary

- We think those with fiduciary responsibilities need to consider just how much risk they take by owning SNAP at current levels.

- This report shows investors of all types just how extreme the risk in SNAP is.

- The stock price implies Snap’s DAU will equal the world, assuming it maintains its current ARPU. At Facebook’s ARPU, the price implies Snap will reach 11% more DAUs than Facebook.

- Looking for more investing ideas like this one? Get them exclusively at Value Investing 2.0 . Get started today »

We first warned investors about SNAP before its IPO in February 2017: Danger Zone: Snap (NYSE:SNAP). We warned again in August 2018, Bursting SNAP’s (Micro) Bubble, before closing the position in February 2019 after the stock had fallen 65% from its IPO closing price while the S&P 500 had increased 14%.

Now, with the stock trading ~155% above where we closed the position, the valuation implies nearly the entire global population will be Snapchat users. Fiduciaries should consider this stock extremely risky, especially in today’s market. Snap is this week’s Danger Zone pick.

We think those with fiduciary responsibilities need to consider just how much risk they take by owning SNAP at current levels. This report shows investors of all types just how extreme the risk in SNAP is based on:

- Lack of competitive advantages vs. fierce, deep-pocketed competitors

- Growth is with very low-spending (aka unprofitable) users

- Doing the math: The stock price implies Snap’s DAU will equal the world assuming it maintains its current average revenue per user (ARPU). At Facebook’s (FB) ARPU, the price implies Snap will reach 11% more daily active users (DAUs) than Facebook.

Growth Will Slow, But Competition for Ad Dollars Will Increase

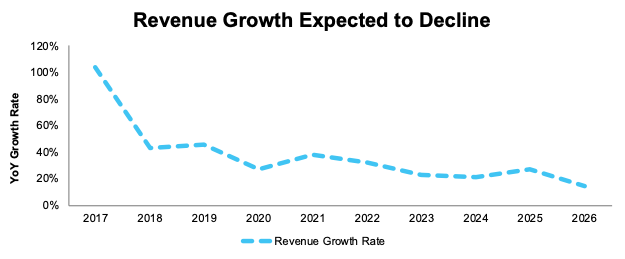

Snap went public riding a wave of rapid revenue growth and the hype of being the next big social media platform. However, that wave crested in 2017 and grows weaker by the day. As the firm attempts to scale up, and more competition enters the market (in some cases directly copying Snap’s core product), it becomes harder to maintain its past growth rates. For example, revenue grew 104% YoY in 2017 and 45% YoY in 2019. Consensus estimates expect revenue will grow 27% YoY in 2020, and just 15% YoY by 2026, per Figure 1.

Snap faces an increasingly uphill battle to grow revenue at high rates as the fight for ad dollars intensifies.

Figure 1: Consensus Revenue Growth Estimates: 2017-2026

Growth Focused in Unprofitable Markets

As with most social media companies, the road to profitability, which is elusive for nearly all but Facebook (FB), begins with growing users.

Unfortunately for Snap, and investors that care about profitability, the firm’s growth is coming from its least lucrative market: “Rest of World.” Snap’s Rest of World DAUs grew 38% YoY in 2Q20, compared to just 11% and 8% for Europe and North America. ARPU in North America is nearly four times as high as Rest of World and three times as high as Europe, per Figure 2.

While the faster growth in the Rest of World segment is partly driven by starting from a smaller base (North America is still the largest segment by DAUs), the lower ARPU in that segment exacerbates the firm’s already negative profitability.