Summary

- CBRE is a leading global real estate services company with deep insights into macro and local real estate markets.

- COVID-19 has presented a challenging operating environment for the company, but I see signs of a rebound.

- The shares appear to be undervalued with strong upside potential.

Commercial real estate has seen its fair share of challenges since the beginning of the pandemic this year. In this article, I’m focused on CBRE Group (CBRE), which is a worldwide leader in real estate services. Since the start of the year, its shares have widely underperformed the market, with a -24% return on a YTD basis. I evaluate what makes CBRE an attractive investment at the current valuation; so let’s get started.

A Look Into CBRE Group

CBRE is a leading global real estate services company with deep insights into macro and local real estate markets. It operates with three primary lines of business. Its Advisory Services segment participates in real estate transactions, property management, and valuation services. Global Workplace Solutions helps clients with strategy, consulting, and facilities management. Lastly, its Real Estate Investments segment helps clients with project development and also acts as an investment manager. Last year, the firm generated $23.9B in total revenue.

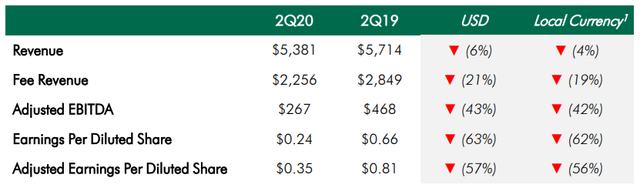

COVID-19 has presented the company with a challenging operating environment. As seen below, revenue and adjusted EPS fell by 4% and 56%, respectively, on a constant currency basis. The larger drop in adjusted EPS was due to weak results in its Advisory Services segment, higher COVID-related costs, and a $16M donation into the company’s COVID Relief Fund.

(Source: Company Earnings Presentation)

Advisory Services posted the weakest results of the three segments, with a 31% drop in fee revenue and a 60% drop in adjusted EBITDA, due in part to the aforementioned COVID-related costs and the donation. On the bright side, Global Workplace Solutions showed resilience with 11% YoY growth in adjusted EBITDA to $116M. I see this segment as being a good stabilizer for the overall business, as CBRE’s clients count on it to run its essential operations during both good times and bad.