Summary

- Since its inception, Snap has failed to generate profits and there’s no indication that the company will reach a breakeven point anytime soon.

- Snap has very little value and no growth prospects in the long run.

- By trading at an EV/Revenue of 16x, Snap is overvalued to its peers and for that reason, we continue to hold a short position in the company.

Since its inception, Snap (SNAP) failed to make a profit and there’s no indication that the company will reach a breakeven point anytime soon. While the company has experienced an increase in revenues in the second quarter of the year, its net loss for the period widened and the overall expenses increased. The reality is that Snap doesn’t have any major competitive advantages in comparison to others. By trading at an EV/Revenue of 16x, Snap is overvalued to its peers and for that reason, we continue to hold a short position in the company.

Forget About Profits

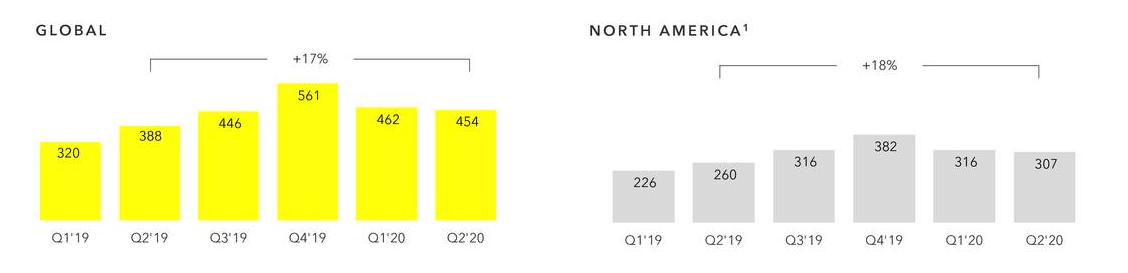

Snap is up more than 10% since we published our bearish article on the company back in June. However, its share price started to slowly depreciate after the company reported mixed Q2 results in late July. From April to June, Snap managed to improve its Discovery feed by signing partnership deals with Disney, ESPN, BuzzFeed, and others. At the same time, it has experienced the increase of the average number of shows watched on the feed by 45% Y/Y, which helped Snap to increase its revenues by 17% Y/Y to $454 million. The problem is that sequentially, Snap’s revenues have been declining for the second quarter straight, even though the vast amount of people spent their time online during the period due to the implementation of nationwide lockdowns around the globe.

Snap Revenues. Source: Snap

In addition, Snap’s average revenue per user of $1.91 was flat Y/Y and down Q/Q.

Snap’s ARPU. Source: Snap

At the same time, Snap’s net loss widened during the period to $326 million from a net loss of $255 million a year ago, and its business generated a negative operating cash flow of -$67 million and a negative FCF of -$82 million. Its DAU of 238 million, was below the street consensus by 0.5 million.