Summary

- Snap delivered a Q2 beat, but saw a substantial decline in growth rates.

- Snap is priced near a 2-year high EV/Sales multiple.

- The company is struggling to generate free cash flow in a tough advertising environment.

- Snap's user growth remains steady.

- I'd rather own other digital advertising companies like Pinterest right now.

Introduction

Snap Inc. (SNAP) is priced substantially higher than any of its peers and is possibly due for further multiple contraction, given what is likely a tougher advertising environment for another quarter or two. User growth appears to be staying steady in all regions, but ARPU in Q2 remained the same as last year. The company still has a solid balance sheet to weather further storms, which has perhaps given investors confidence to bid shares up to a 2-year high sales multiple. Investors should proceed with caution and only consider adding or initiating a position on dips from here, in my opinion.

What Happens Going Forward

Going forward, Snap, eventually, will have to get to positive free cash flow to maintain a sustainable business model. While I think they'll get there, it could take a few years yet. Disruptions like COVID-19 can clearly have a negative effect on the company's ability to generate free cash flow, as one will see in the Q2 earnings recap below. I find this concerning, and I'm surprised the stock hasn't declined more after the earnings report (year to date, the stock is still up 40%, yet short-term expectations have almost certainly declined from the beginning of the year).

Growth could pick back up in the back half of the year as businesses re-open and more business is conducted online. This could be good for digital advertising companies like Snap and, along with user growth, is probably why the stock has soared along with other technology and internet companies. The fundamentals, however, don't yet support the 40% year-to-date performance, in my opinion.

Q2 2020 Earnings Recap

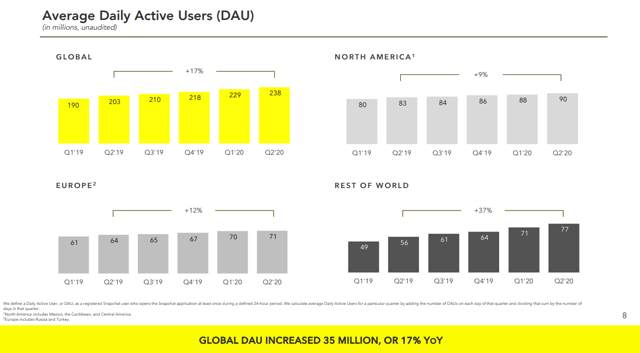

Snap reported GAAP EPS of -$0.23 in Q2 2020 earnings, in line with analyst estimates. Revenue came in with a surprisingly robust number of $454M, beating estimates by almost $10M in a challenging advertising environment. This was good for a revenue growth rate of 17% overall. Readers should note that this is down from the 40%+ revenue growth rate numbers the company had been putting up over the previous four quarters. Global Daily Active Users grew 17% year over year, the same rate as revenue. This meant ARPU came in flat globally.

Breaking these numbers down by region tells an interesting story. Globally, DAUs grew 17%, with huge growth in rest of world of 37% (India itself grew DAUs by 100% YoY as mentioned on the conference call), while North America and Europe grew a much more modest 9% and 12%, respectively.

Source: Snap Q2 2020 Investor Presentation

ARPU for rest of world declined substantially. North America and Europe still grew ARPU, but these gains were entirely offset by rest of world's decline, as global ARPU remained flat.