Summary

- After a strong first quarter, KB Home saw a huge new orders drop in its second quarter.

- The company is not at risk of bankruptcy, even if the crisis is prolonged. However, after the recent rally, the risk-reward is terrible.

- I will be buying if the market offers another deep correction opportunity. Other than that, it is best to avoid high-volatility stocks.

It's time to discuss KB Home (KBH). This Los Angeles, CA-based homebuilder just reported its second-quarter earnings after erasing all COVID-19 stock price losses in June. While I have been on the sidelines, as I distrusted the steep rally in homebuilding stocks, I am afraid that we are at a point where homebuilding sentiment needs to approve. While KB Home was able to report good earnings, its new orders were down big, with only a small improvement towards the end of the quarter. While I won't be shorting anything, I am staying far away from homebuilders for the time being.

Source: KB Home

Here's What Happened In Q2

First of all, let's start by mentioning that the company's second quarter started in March and ended at the end of June. In other words, this quarter included the full impact from the almost nationwide shelter-in-place orders.

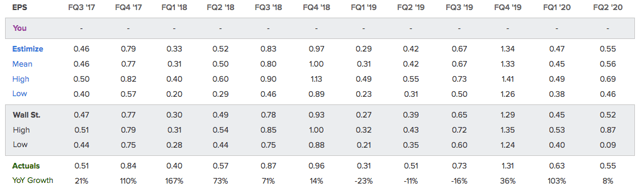

That said, KB Home generated earnings worth $0.55 per share. That's slightly above expectations and 8% up compared to the prior-year quarter. It marks the third consecutive quarterly improvement. Additionally, the company hasn't reported earnings below expectations in years.

Source: Estimize

Unfortunately, total housing revenues totaled $910 million, compared to more than $1.0 billion in the prior-year quarter. This translates to a 10% decline, as overall deliveries were down 10%, with average selling prices declining roughly 1% to $364,100. Deliveries were down, as the COVID-19 pandemic caused severe economic and social disruptions and added uncertainty during the quarter. This caused cancellations to rise. While prices were down as well, the company believes the full-year average selling price to be in the $385K-398K range.

Fortunately, the company's operating income margin, adjusted for inventory changes worth $4.4 million and severance charges of $6.7 million, came in at 6.9%. This is an improvement of 140 basis points. The housing gross profit margin improved 100 basis points to 18.2%, as the mix of homes delivered and lower amortization of capitalized interest, partly offset by lower housing sales, was able to provide a much-needed boost.

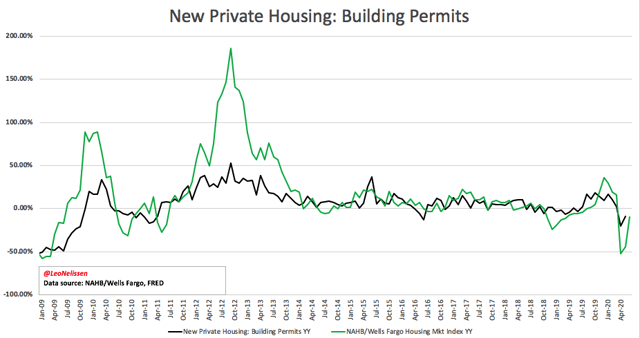

With that said, sales, margins, and earnings are backward-looking. What matters more is how new orders are doing. This will determine deliveries and sales going forward. Unfortunately, new orders absolutely imploded and were down 57% from the prior-year quarter. This is without a doubt a terrible number. What makes it worse is that nationwide building permits declined roughly 9% in the company's second quarter.

The good news is that demand in markets like Houston improved as restrictions were eased, while overall new orders in June (third quarter) were mostly up compared to the prior-year quarter. To be precise, the improvement in June was 2%. While some might say it's low, I believe it is too soon to call it a rebound.

We have entered a situation where data absolutely has to improve. Why? Simply because the stock has priced in higher growth. Right before the earnings call, the stock was almost flat for the year. Meanwhile, everything impacted by the virus is down more than double digits (airlines, retail etc.).