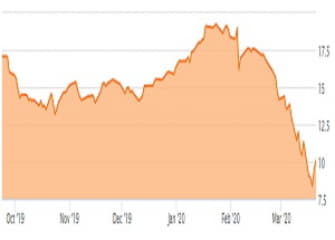

The social media space has been decimated during the market collapse on fears that ad revenue from small and medium businesses will not only disappear in the short term but never return in the future. Due to ongoing free cash flow losses, Snap (SNAP) remains the stock at most risk of a protracted slowdown. My investment thesis wanted investors out of the stock up at $17 and the relative value proposition hasn't gotten any better with the dip to $10.

The easy story here is that Snap is cash flow negative and the coronavirus outbreak is only going to make these numbers worse. The company already guided to an adjusted EBITDA loss for Q1 of at least $80 million.

READ FULL ARTICLE HERE