Summary

- BioVie has filed proposed terms for its $15 million IPO.

- The firm is developing a treatment for ascites, a liver-related condition.

- BIVI has shown promising results in very limited trials to-date; the IPO is ultra-high-risk and likely more suitable for institutional, long-term investors.

- Looking for a community to discuss ideas with? IPO Edge features a chat room of like-minded investors sharing investing ideas and strategies. Start your free trial today »

Quick Take

BioVie (OTCQB:BIVI) has filed to raise $15 million in a U.S. IPO, according to an amended registration statement.

The company is developing a terlipressin-based therapy for the treatment of ascites.

BIVI is a tiny biopharma with little in the way of resources and a long road ahead for treatment approval, so the IPO is ultra-high risk.

Company & Market

Los Angeles, California-based BioVie was founded in 2013 to develop and market new therapies for the treatment of life-threatening chronic liver diseases and associated complications.

Management is headed by Chairman and CEO Terren Peizer, who has been with the firm since 2018 and was also founder and CEO at Acuitas Group Holdings, Catasys, and NeurMedix.

BioVie is advancing BIV201, a continuous infusion ‘terlipressin’ therapy that is currently being developed for the treatment of ascites due to chronic liver cirrhosis from hepatitis, non-alcoholic steatohepatitis [NASH], or alcoholism.

Terlipressin is currently approved for marketing in about 40 countries except for the US.

According to management, ascites affects about 100,000 Americans and carries an estimated 40% mortality rate within two years of diagnosis.

BIV201’s development originally began at LAT Pharma, which BioVie acquired alongside its BIV201 program as well as its development and marketing rights.

The firm has a US patent that covers the use of BIV201 for the treatment of ascites due to liver cirrhosis, and corresponding patent applications pending in Japan, Europe, China, and Hong Kong.

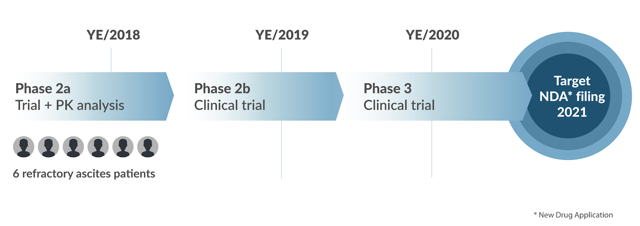

Below is the current status of the company’s estimated drug development timeline for BIV201:

Source: Company website

Investors in BioVie include Aspire Capital, Cuong Do, the global strategy lead for Samsung, and the founder of Adheron Therapeutics, Hari Kumar. Source: Linkedin.

According to a report by Allied Market Research, the global liver disease and complications treatment market was projected to reach $19.5 billion in 2022.

From 2016 to 2022, the market is expected to grow at a CAGR of 11.72%.

The main factors driving market growth are an increasing consumption of alcohol, rising incidence of liver diseases as well as the growing geriatric population suffering from liver diseases.